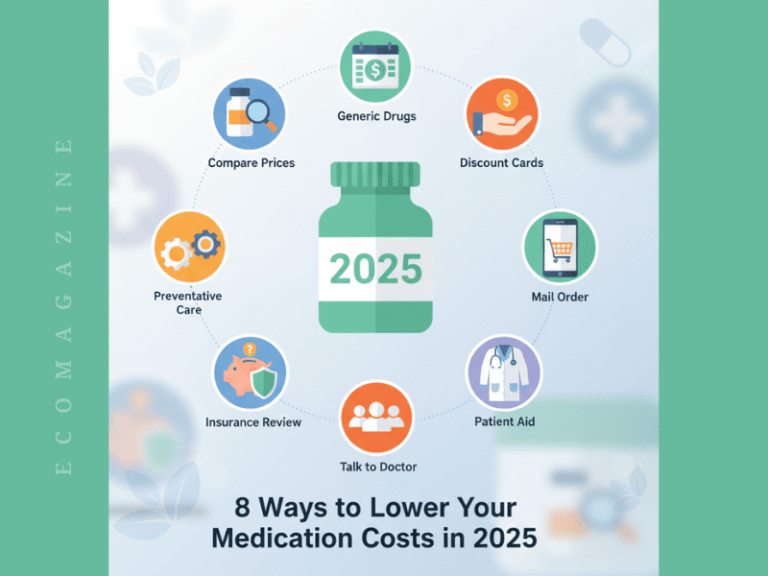

Whatever your situation or health condition is, cutting prescription costs in 2025 is very possible. With some trend-smart strategies and the right resources, you can pay less, stay consistent with your treatment, and keep more money in your pocket without your health getting compromised in any way.

1. Explore Patient Assistance & Savings Programs

Some people are also investing in your health, so look into helpful programs you may qualify for from manufacturers, nonprofit foundations, or copay funds in your location.

For example, institutions like the PAN Foundation in 2025 opened a copay fund for obesity medications (including GLP‑1s), offering up to $1,000 every year toward your out‑of‑pocket expenses. Other resources, like NeedyMeds, can provide you with searchable databases for free or low‑cost drug programs in your community or your state.

2. Use Insurance Changes & Legal Caps to Your Advantage

You need to keep tabs on what insurance reforms are active in 2025 because they can affect your costs directly, like:

- Maximizing the $2,000 cap on annual out‑of‑pocket costs for Medicare Part D prescriptions.

- Laws (local and national) are pushing for limiting consumer out‑of‑pocket costs for GLP‑1 therapies and treatments for some conditions, like obesity. It’s to improve access, reduce cost-sharing, and regulate benefit blueprints.

Why They Matter

Knowing what your own insurance covers, what your plan’s formulary tiers are, and when these reforms kick in will help you map out and plan refills or choose medications that match your finances.

3. Compare & Shift Where You Buy; Use the Right Resources

Using the right resources is often your most immediate and underused lever, so you may need to:

- Compare pharmacies: local vs online vs big chain vs independent.

- Maximize discount cards or coupons: third‑party platform saving cards for brand-name and generic meds.

- Check mail‐order or 90‑day supplies if your insurance allows.

- Explore specialty funds when dealing with high‑cost or more recent drugs.

You may also explore new avenues, like Trulicity weight loss help, especially when you’re looking into GLP‑1 or similar prescriptions. This can guide your choices of prescriptions and can inform you of typical costs, coverage scenarios, and support programs for the precise drug you need. It’s also a handy resource for real‑world comparisons you can use when negotiating or choosing your coverage.

4. Leverage Formulary Tiers, Generics, & Therapeutic Alternatives

When your doctor prescribes, you can always ask:

- For a generic or bio similar version of your med.

- For them to prescribe a lower‑cost but clinically comparable drug.

- Whether your insurance formulator changes each year.

Oftentimes, asking and knowing the upcoming year’s tiers may allow you to switch before high cost kicks in. You may also work with financial advisors in the field to help you walk through your medical situation and needs. This way, you can at least have a rein over the ever-increasing costs of prescription meds.

5. Time Your Refills & Use Bulk or Long‑Supply Discounts

Most often, savings may come from some craftiness, like:

- Ordering a 90‑day supply instead of 30 days. Many plans give discounts or lower copays.

- Refilling at times when discounts or promotions are active.

- Scheduling your refills right after a benefits period resets or a deductible resets.

6. Use Health Savings Accounts, Flexible Spending, or Tax Deductions

If you have an HSA (Health Savings Account) or FSA, fund it with as much as your legal limits may allow. This way, you use your pre‑tax dollars to pay for medications, and you reduce your after‑tax costs.

Also, some states offer credits, or federal taxes allow some medical expenses to be deducted if you itemize and exceed thresholds.

7. Prioritize Medication Adherence & Preventive Health

Often, spending a bit more now to stay focused on your health avoids costly complications in the near future. However, if you skip doses or stretch supplies, you may end up being hospitalized or needing more intense treatments, which can cost far more than earning some savings from skipping your meds.

8. Review Your Insurance Annually & Switch If Needed

It’s most possible that there’s a yearly change in your insurance or plans, like tier placements, copay amounts, and deductibles shift, so you may need to:

- Compare different insurance/Medicare/Medicaid plans to see which offers the best coverage

- Prioritize plans with much lower total annual cost for your set of meds, rather than just a monthly premium.

- Ask your provider or pharmacist if there are plan adjustments that can help reduce your out‑of‑pocket spending

Bottom Line

Managing all your medication costs in 2025 is about being resourceful, informed, and highly proactive. When you combine financial strategies with smarter choices, you’ll be able to protect both your health and wallet while staying consistent with the treatments your well-being may depend on.